Technology has amazingly evolved a lot in almost every practical aspect of our lives, including managing our bank money. With the marvelous rise of free online banking apps, the days of long lines at the bank and limited banking hours are mostly behind us. These tools let people handle their financial tasks right with their smartphones. So, this guide will share a comprehensive list of the best mobile banking apps and you can find the best mobile banking app you like in 2025.

What is a Mobile Banking App?

A mobile banking app makes users able to manage their financial transactions directly from their mobile devices. Typically, these applications are provided by banks and financial institutions, giving customers a convenient way to access their accounts. Also, features like real-time notifications and secure login methods provide a user-satisfied platform for personal financial management.

In addition, many U.S. bank apps offer advanced features like mobile check deposits and customer support chat to enhance user experience. Overall, these financial applications have become essential tools for modern banking, offering the convenience of managing finances on the go.

What Can You Do Through a Banking App?

Banking applications in America allow users to inspect their balance amount and serve them with many valuable features. Here are some of the key activities you can expect from these innovative financial applications:

- Check Account Balances and History: Just by using a few taps on your mobile screen, you can quickly view your account balances and recent transactions. In this way, you can stay informed of your financial status without requiring physical branch visits.

- Transfer Funds: Evidently, banking apps enable you to share money to any selected account with flexible capabilities. Besides, you can set up one-time transfers or even adjust scheduling for automatic transferring of money on consistent time.

- Pay Bills: Many U.S. Bank mobile apps allow you to pay utility bills and other payments directly through your smartphone. Additionally, they facilitate in automatic scheduling of bill payments to avoid due date latency.

- Manage Cards: You can manage your transaction cards through the app by setting spending limits or activating new cards. Moreover, some financial apps let you temporarily lock or unlock your card for added security.

- Access Customer Support: Conveniently, banking applications often include customer support options with phone calls and live chat support. As a result, you can get prompt assistance with your accounts and resolve unknown issues without hassle.

Top 10 Mobile Banking Apps

Now that you are aware of the possible perks users can enjoy from these money-handling applications, let’s explore further. Here, we will list the 10 best online banking apps you can confidently rely on for financial managerial work.

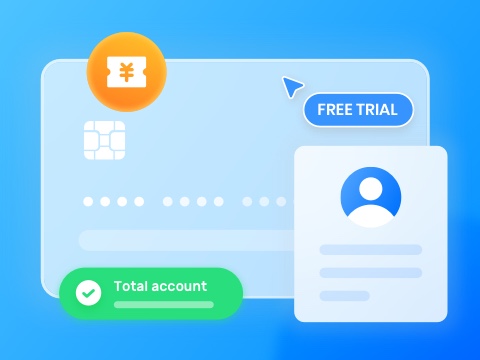

1. Wells Fargo Mobile (iOS | Android)

This best banking mobile app offers users the convenience of Touch ID or Face ID, where they can securely access their cash and investment amounts. Interestingly, it enables easy monitoring of account activity and balances, along with the management of credit card transactions. Moreover, Wells Fargo allows users to deposit checks using their iPhone camera, with immediate viewing of the processed deposit.

Pros

- The app prioritizes security with biometric authentication, along with the ability to manage alerts and report fraud.

- With the advanced card management options, users can easily activate or deactivate cards on the go.

Con

- Wells Fargo’s extensive features and settings may be overwhelming for some users, especially those who are not tech-savvy.

Apple App Store Rating: 4.9/5

Google Play Store Rating: 4.8/5

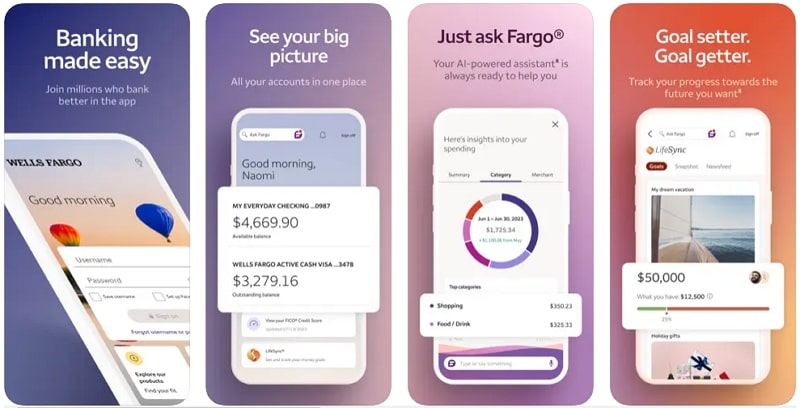

2. U.S. Bank Mobile Banking (iOS | Android)

The U.S. Bank mobile app offers a secure platform where users can log in using their digital credentials. Also, they can enroll directly through the app if they don’t have online access. Here, the app provides alerts for duplicate charges and suspicious activities, which enhances the security even further. Besides, users can manage their accounts by setting travel notifications and adding them to mobile wallets.

Pros

- This application offers personalized insights into spending patterns and recommendations for saving money.

- It also provides users with a voice-activated tool, U.S. Bank Smart Assistant, that helps them manage accounts and find important information.

Con

- Currently, you can get only English and Spanish language support, which may limit accessibility for users who speak other languages.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.4/5

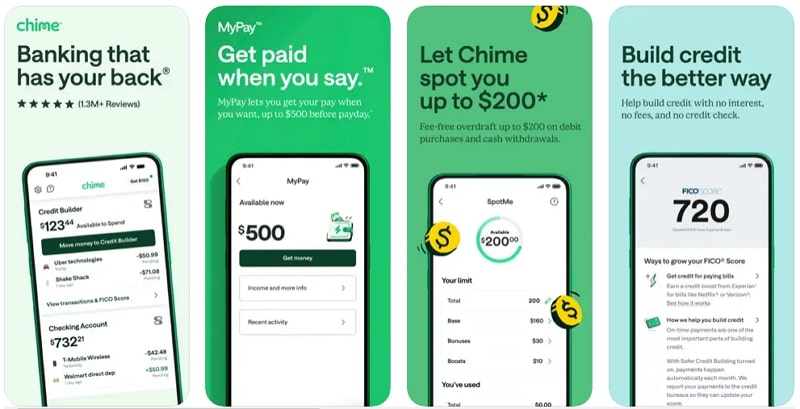

3. Chime (iOS | Android)

Chime enables users to manage their finances securely through features like instant transaction notifications and daily balance alerts. Evidently, this money-handling app comes up with two-factor authentication security and the ability to freeze your card with a single tap. Also, its MyPay feature allows you to access up to \$500 of your earned wages without a credit check. Besides, you can overdraft up to \$200 on Chime debit card purchases with its SpotMe functionality.

Pros

- Chime offers a transparent fee structure with no monthly fees or foreign transaction fees, making it cost-effective for users.

- The Credit Builder Visa Card helps users improve their credit scores with no interest, providing valuable financial growth.

Con

- While Chime covers basic banking needs, it may not offer the full range of financial products and services found at traditional banks.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.7/5

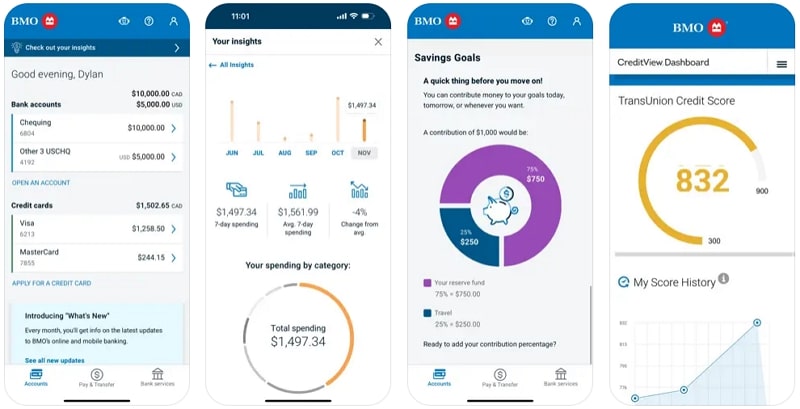

4. BMO Bank (iOS | Android)

Another one of the best online banking apps is BMO, which features an Account Summary view to let users access their banking and investment balance. Here, you can manage bill payments and set up future-date payments, making this best mobile banking app simple to stay on top of finances. Furthermore, the app supports saving frequently used BMO cards with nicknames for faster sign-ins.

Pros

- Protected by the 100% Electronic Banking Guarantee, users are repaid for any losses due to unauthorized transactions.

- Users can sign in quickly and securely using Touch ID and enjoy the convenience of Apple Pay.

Con

- While cross-currency transfers are supported, the app may have limitations in offering comprehensive international banking services.

Apple App Store Rating: 4.6/5

Google Play Store Rating: 4.6/5

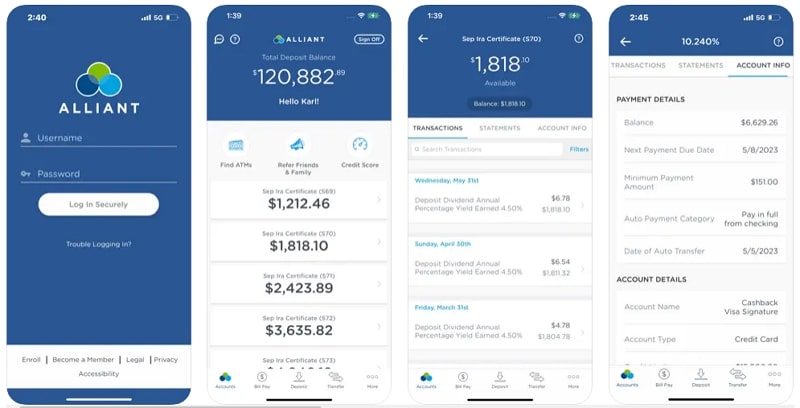

5. Alliant Mobile Banking (iOS | Android)

This American bank app supports a range of essential features where you can transfer money between accounts and pay bills with the ability to add new payees. In particular, it features a secure messaging system for communicating with customer service and a tool to keep track of finances. Additionally, there’s a balance preview option that lets you check your account balance without fully logging in.

Pros

- Built-in help features provide instant answers to common questions, enhancing the overall user experience.

- This best banking app gives you the ability to customize the display order of your accounts for easy access.

Con

- As a digital-first platform, the app may lack in-person support options, which could be a drawback.

Apple App Store Rating: 4.7/5

Google Play Store Rating: 4.4/5

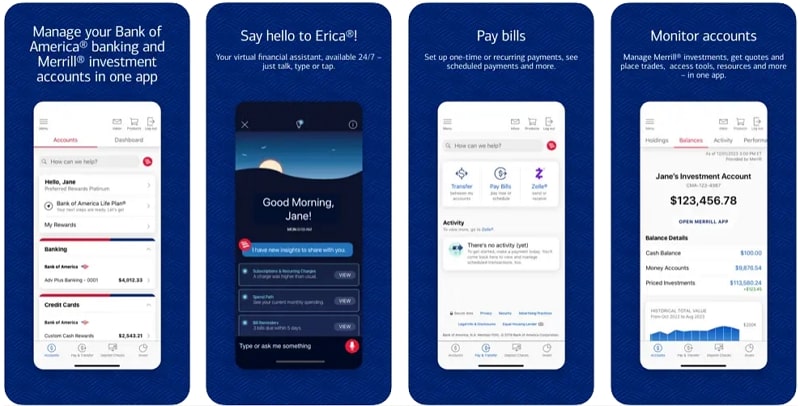

6. Bank of America (iOS | Android)

Bank of America facilitates seamless money transfers and bill payments with Zelle using a U.S. mobile number. Interestingly, it supports funds transfers with linked Merril accounts, enhancing integration between banking and investment services. In addition, this US bank app provides users with a virtual financial assistant who provides helpful alerts and insights.

Pros

- Face ID and proactive fraud notification options offer robust security measures to protect users’ accounts.

- With the Mobile Banking Security Guarantee, users are not liable for fraudulent transactions when reported promptly.

Con

- Some features, such as access to Erica or advanced investment tools, may be limited based on account type.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.6/5

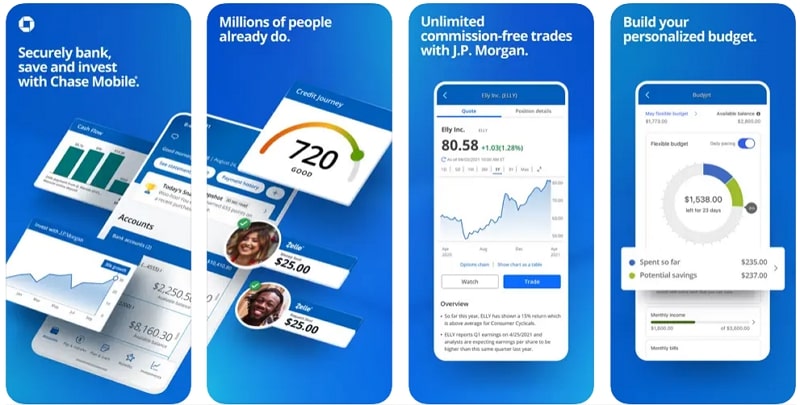

7. Chase Mobile (iOS | Android)

Here is another best mobile banking app that lets users review their account activity across various accounts. Conveniently, the app allows for seamless check deposits using Chase QuickDeposit while offering easy ways to send money. It also offers Chase Credit Journey for monitoring your credit score and receiving free identity monitoring. Additionally, it helps users to manage their budgets and track their spending with daily insights.

Pros

- Users can schedule meetings with advisors and manage their investments directly from this financial app.

- The app helps users find Chase branches and ATMs and offers 24/7 customer support.

Con

- Specific investment tools and rewards may only be available to eligible customers, limiting access for some users.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.4/5

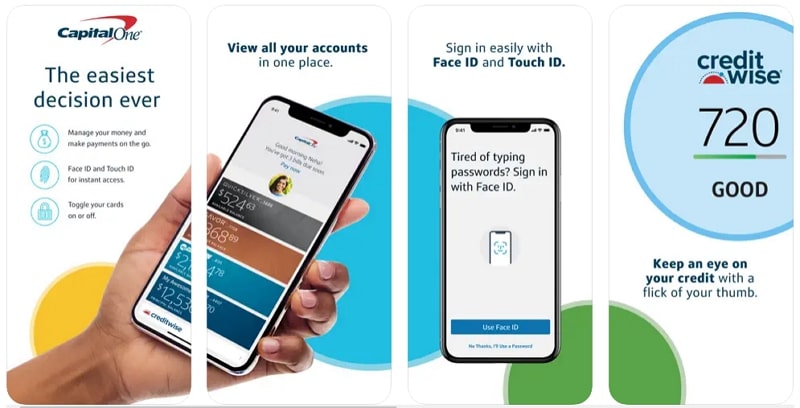

8. Capital One (iOS | Android)

Capital One offers a unique CredWise feature that allows users to monitor their credit scores and track changes. Additionally, this best online banking app supports reward redemption on the go and money transfers with friends and family through Zelle. Besides, it offers detailed transaction histories and instant card-locking capabilities, enhancing security.

Pros

- With detailed transaction views and instant card locking, the app ensures users can protect their accounts effectively.

- This app also includes alerts and notifications for account activities, providing timely updates on purchases and other transactions.

Con

- It requires internet access for most functionalities, which can be a limitation during service outages.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.5/5

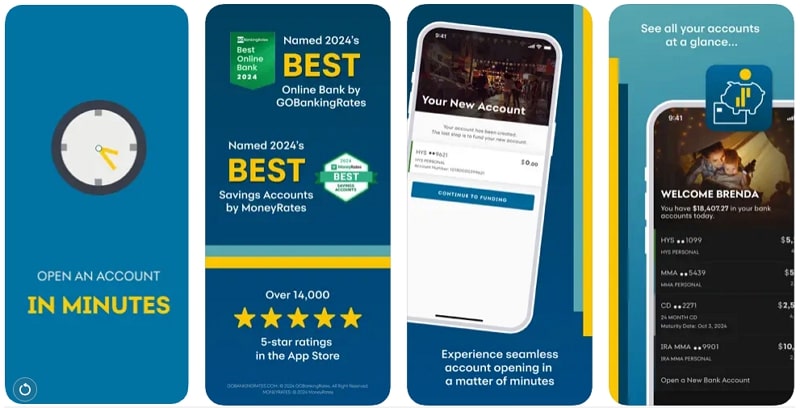

9. Synchrony Bank (iOS | Android)

Users can open new accounts within minutes and manage existing accounts with ease, thanks to the Synchrony Bank app’s intuitive interface. Evidently, it allows you to track your account activity and check balances at a glance with convenient widgets. Furthermore, this U.S. bank app supports renewing CD accounts and managing beneficiaries, making it a comprehensive tool for savings.

Pros

- The app is designed to be inclusive, with screen reader compatibility, ensuring it is accessible to all users.

- Moreover, users can connect with the customer service team of this award-winning bank and have a quick chat during business hours.

Con

- It may lack some of the more transactional features found in traditional banking apps, such as bill payment and budgeting tools.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.7/5

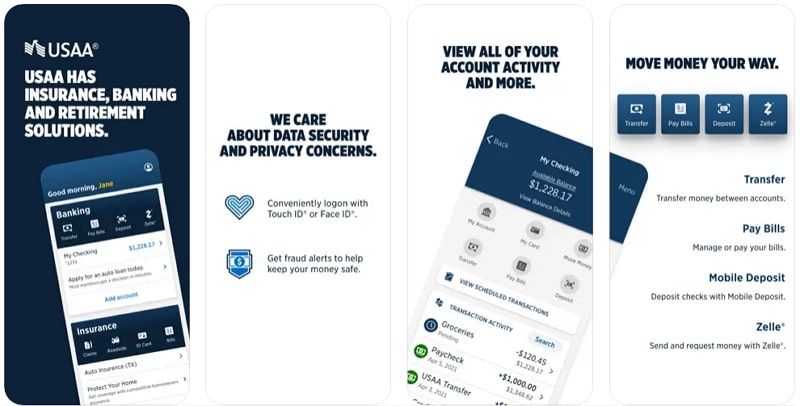

10. USAA (iOS | Android)

As another best mobile banking app, the USAA Mobile app meets the unique financial and insurance needs of military members. In particular, the app makes it easy for users to find the nearest ATM with its distinct ATM locator. Additionally, it provides functionalities like accessing auto I.D. cards and requesting roadside assistance. Besides, users can manage their investments through the app, ensuring a holistic approach to their financial management.

Pros

- This peculiar financial app features an intelligent search function and chat support to help users find what they urgently need.

- It also includes specified widgets that allow users to view their current balance and transaction history directly from their home screen.

Con

- The app is exclusively available to USAA members, which limits its accessibility to the broader public.

Apple App Store Rating: 4.8/5

Google Play Store Rating: 4.0/5

How to Choose an Online Banking App

After going through a whole bundle of applications, it’s not easy to decide which of them you should choose and that fits your needs. Therefore, we will now make this best banking app selection easy for you by presenting some of the essential factors you must consider.

- Security Features: Look for apps that offer strong security measures like multi-factor authentication and the ability to control cards from the app.

- Ease of Use: The app should be with easy navigation and clear instructions, especially features like quick access to account balances.

- Available Features: You must consider what kind of features the particular application is offering. So, make sure the app offers features that align with your financial goals.

- Customer Support: Reliable customer support is essential, especially when dealing with financial issues. Here, check if the app offers 24/7 support or easy access to service representatives.

- Accessibility and Compatibility: Ensure that the app is compatible with your device and operating system, offering features like screen reader adjustability.

Essential Features of Mobile Banking App

As mobile banking becomes the norm, apps must offer not only convenience, but also security, real-time support, and seamless user experiences.

1.User Authentication & Security

- Biometric login (Face ID, fingerprint)

- Two-factor authentication (2FA)

- End-to-end encryption for all transactions

2. Account Management

- View account balance & transaction history

- Manage multiple accounts or cards

- Card locking/unlocking and limits control

3. Fund Transfers & Payments

- Peer-to-peer (P2P) transfers

- Bill payments, QR code scanning

- Scheduled and recurring payments

4. Push Notifications & Alerts

- Real-time alerts for transactions, suspicious activity

- Personalized messages for offers or updates

5. Customer Support Integration

- In-app live chat or video assistance

- AI chatbot for quick FAQs

- Secure document sharing with support

6. Personal Finance Tools

- Budget tracking & spending insights

- Goal-based savings features

- Credit score monitoring

7. ATM & Branch Locator

- GPS-based locator with filters (e.g. deposit-enabled ATMs)

8. Multi-language & Accessibility Support

- Language options

- Dark mode, voice-over compatibility, screen reader support

How Can ZEGOCLOUD Help for Mobile Banking Apps

Even if you have chosen the best online banking app by considering all essential factors, there’s room for further optimizations. In this regard, you can confidently get assistance from a trustworthy API provider, ZEGOCLOUD. Conveniently, it enables voice chat features within mobile banking apps that allow users to interact directly with support representatives in real time.

Moreover, it facilitates mobile banking apps offering remote advisory services, where customers can have face-to-face consultations with financial advisors. In addition, ZEGOCLOUD’s technology can be integrated to provide real-time notifications and alerts via voice messages. This can be particularly useful for alerting customers about suspicious activity on their accounts.

Other than that, ZEGOCLOUD can support multilingual customer interactions for banks operating in multiple regions. Not to mention, it helps banking apps to integrate facial recognition for secure login and transaction authorization.

Conclusion

In conclusion, financial handling has become a game changer since the arrival of online banking applications. Considering this, we have explained everything about these apps and how they can benefit you in various ways.

In particular, the guide shared the best mobile banking apps along with their official ratings on Android and iOS platforms. As a bonus, we have even presented you with a reliable way to optimize banking apps via ZEGOCLOUD.

Read more:

FAQ

Q1: What features should I look for in the best mobile banking app?

The best mobile banking apps should offer features such as robust security measures (like two-factor authentication), easy-to-use interfaces, quick and efficient customer support, real-time transaction notifications, bill payment options, fund transfers, mobile check deposits, budgeting tools, and seamless integration with other financial services.

Q2: How secure are mobile banking apps?

Mobile banking apps are generally very secure as they use advanced encryption technologies to protect your data. Features like biometric authentication (fingerprint or facial recognition), two-factor authentication, and real-time fraud monitoring add additional layers of security. It’s important to download apps only from official app stores and keep your device’s software up to date.

Q3: Are there any fees associated with using mobile banking apps?

Most mobile banking apps are free to download and use. However, some banks may charge fees for specific services, such as expedited payments, overdraft protection, or international transactions. It’s essential to check with your bank for any potential fees related to using their mobile banking app.

Let’s Build APP Together

Start building with real-time video, voice & chat SDK for apps today!